25. June 2021

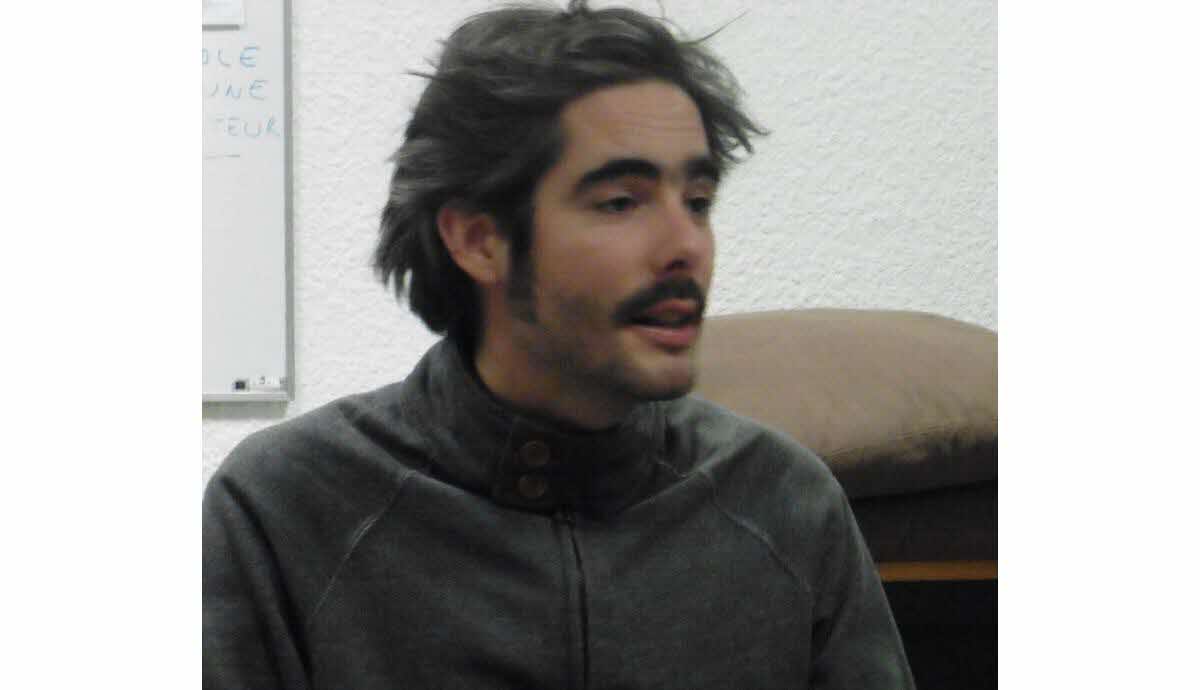

Bienvenue sur mon site : je vous présente Mael Le Mée, ainsi que mes découvertes cinématographiques

Bienvenue sur mon blog consacré à Mael Le Mée, un réalisateur de talent que je souhaite vous faire découvrir, à travers de nombreux articles et des revues concernant ses différentes oeuvres. Sur mon blog, je souhaite également vous présenter mes goûts, en matière de cinéma et de séries. C’est vrai, depuis tout petit, je suis un mordu d’oeuvres cinématographiques. Mes parents étant cinéphiles, j’ai attrapé le virus alors que j’étais très jeune. Afin d’assouvir ma passion pour la découverte des nouveaux films, je vais au cinéma au moins deux fois par semaine. Bien sûr, je possède un compte Netflix sur lequel je regarde toutes les nouvelles séries. Vous aussi, vous êtes fan de Mael Le Mée et de cinéma de façon plus générale ? Dans ce cas, mon blog devrait vous intéresser.

Mael Le Mée, un réalisateur français de talent !

Connaissez-vous Mael Le Mée ? Il s’agit d’un réalisateur qui, d’après moi, est trop peu connu ! Cependant, vous connaissez peut-être ses réalisations ! Il s’agit des 4 Histoires Fantastiques, sorti en 2018, de Jet Groover, un film d’animation de 2009, de Flatmania sorti en 2004 et d’Aurore, sorti en 2017. Vous ne connaissez pas ces différents longs métrages ? Dans ce cas, je vous encourage vivement à y jeter un coup d’oeil. Toutes les créations de Mael Le Mée sont de qualité supérieure. J’aime particulièrement la sensibilité qui s’en dégage, ainsi que l’originalité de la mise en scène.

Je vous parlerai dans d’autres articles, un peu plus en détail, des différentes oeuvres de Mael Le Mée ainsi que de son parcours.

Sur mon blog, je vous parle de mes films préférés et de mes découvertes

Vous l’avez compris, je suis un amoureux de cinéma. Bien sûr, j’aime les films de Mael Le Mée, mais pas seulement. J’ai des goûts particulièrement éclectiques. En effet, je suis un passionné du cinéma sud-coréen, mais j’apprécie également les films d’animation, et notamment les productions françaises. Dans un prochain article, je me ferai un plaisir de vous parler un peu plus en détail des studios de création made in France !

Je ne me lasse pas des films de Tarantino, qui sont pour moi de véritables chefs d’oeuvre. Je vous recommande d’ailleurs vivement Reservoir Dogs. Je ne manquerai pas, dans une prochaine publication, de vous présenter mes 5 réalisateurs préférés. Et pourquoi pas le top 10 de mes films favoris, pourquoi pas ? Mais, en attendant, j’aimerais vous présenter ma passion pour les séries.

Découvrez mes séries favorites, et mon avis sur les dernières sorties

Comme bon nombre d’entre vous, j’utilise Netflix au quotidien pour découvrir de nouvelles séries. Sur mon blog, j’ai envie de vous proposer mon avis sur les séries les plus connues de la plateforme, mais aussi sur les autres séries moins connues.

Mes séries préférées ? Game of Thrones, Twin Peaks, mais aussi Breaking Bad ou encore Le Jeu de la Dame. Mais j’avoue être également très fan des animés japonais, que je ne manquerai pas de vous présenter ici.

Tenez-vous au courant : régulièrement, je prévois de vous proposer du contenu exclusif.